Tax Rebates: Upgrading Your Electrical Panel

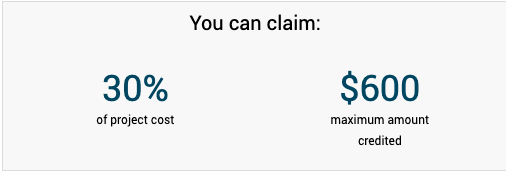

Our government incentivizes individuals and businesses to adopt energy-efficient measures to combat inflation and reduce energy costs. One such initiative, the Inflation Reduction Act, has opened exciting opportunities for homeowners to upgrade their electrical panels while enjoying substantial tax rebates.

Let's discuss the details of the tax rebates available for upgrading your electrical panel under the Inflation Reduction Act. We'll explore the benefits, eligibility criteria, and the impact such upgrades can have on your energy efficiency and bottom line.

Tax Credits for Homeowners

Understanding the Inflation Reduction Act

The Inflation Reduction Act, introduced as a response to rising inflation and energy costs, aims to encourage the adoption of energy-efficient technologies and practices. This act provides financial incentives to individuals who invest in energy-efficient upgrades, including electrical panel improvements.

What Qualifies for this Credit?

Any improvement to, or replacement of, a panelboard, sub-panelboard, branch circuits, or feeders which:

- is installed in a manner consistent with the National Electric Code,

- has a load capacity of not less than 200 amps,

- is installed in conjunction with and enables the installation and use of:

- any qualified energy efficiency improvements, or

- any qualified energy property (heat pump water heater, heat pump, central air conditioner, water heater, furnace or hot water boiler, biomass stove or boiler)

Source: https://www.energystar.gov/about/federal_tax_credits/electric_panel_upgrade

Benefits of Upgrading Your Electrical Panel

- Enhanced Energy Efficiency: Outdated electrical panels are often less efficient, leading to energy wastage. Upgrading to a modern, energy-efficient electrical panel can significantly reduce your electricity consumption and, in turn, your energy bills.

- Increased Property Value: An updated electrical panel improves your property's energy efficiency and adds value to your home or commercial building. It's an attractive feature for potential buyers or tenants.

- Safety and Reliability: Due to wear and tear, older electrical panels may pose safety risks. Upgrading your panel ensures a safer electrical system and reduces the risk of electrical fires.

ENERGY STAR HOME UPGRADE

Eligibility for Tax Rebates

To be eligible for tax rebates under the Inflation Reduction Act, there are a few key considerations:

- Compliance with Energy Efficiency Standards: Your electrical panel upgrade must meet specific energy efficiency standards outlined in the act. Ensure your contractor uses approved equipment and follows the recommended guidelines.

- Approval from Relevant Authorities: Your upgrade should be authorized and approved by local and federal authorities responsible for energy regulations and standards.

- Proof of Expenses: Keep detailed records of all expenses related to the electrical panel upgrade. These records will be crucial when applying for tax rebates.

- Filing Within the Deadline: The Inflation Reduction Act typically has a period during which you can apply for tax rebates. Be sure to file your claim within this timeframe.

Who can use this credit?

Principal Residence Owners

Must be an existing home and your principal residence. New construction and rentals do not apply.

A principal residence is the home where you live most of the time. The home must be in the United States. It can include a house, houseboat, mobile home, cooperative apartment, condominium, and a manufactured home.

Source: https://www.energystar.gov/about/federal_tax_credits/electric_panel_upgrade

Maximizing Your Savings

To maximize your savings under the Inflation Reduction Act, consider the following tips:

- Consult a Professional: Seek advice from an experienced electrician or energy consultant who can help you select the most energy-efficient equipment.

- Combine Upgrades: If you plan multiple energy-efficient upgrades, consider bundling them. You can often receive more significant tax rebates for comprehensive projects.

- Keep Records: Maintain meticulous records of all expenses related to your electrical panel upgrade. These will be crucial when applying for tax rebates.

- Stay Informed: Keep yourself updated on the latest developments related to the Inflation Reduction Act and other energy efficiency initiatives. New opportunities may arise that could further enhance your savings.

Upgrading your electrical panel under the Inflation Reduction Act is a win-win situation. You enjoy increased energy efficiency, safety, and property value and receive generous tax rebates that help offset your expenses. As governments worldwide intensify their efforts to reduce inflation and promote energy efficiency, seizing opportunities like these can significantly impact your finances and the environment.

Remember that the Inflation Reduction Act is just one of many initiatives designed to reward those who invest in energy-efficient upgrades. Be proactive, explore your options, and consult with professionals to maximize these incentives. Upgrading your electrical panel is not just a responsible choice; it's also a financially savvy one.